NUS IREUS Industry Forum

Theme: There's No Place like Home: Local Asset Concentration,

Information Asymmetries and Commercial Real Estate Returns

Date/Time: 21st September 2017, 9.30am – 12.00noon

Venue: Shaw Foundation Alumni House Auditorium

This forum forms part of a series of annual signature events organized by the NUS Institute of Real Estate and Urban Studies (IREUS). Such events serve as platforms for engaging minds and act as bridges between business leaders and subject matter experts in the academia where industry-relevant research findings can be disseminated, shared and debated.

Click Here for Forum Programme

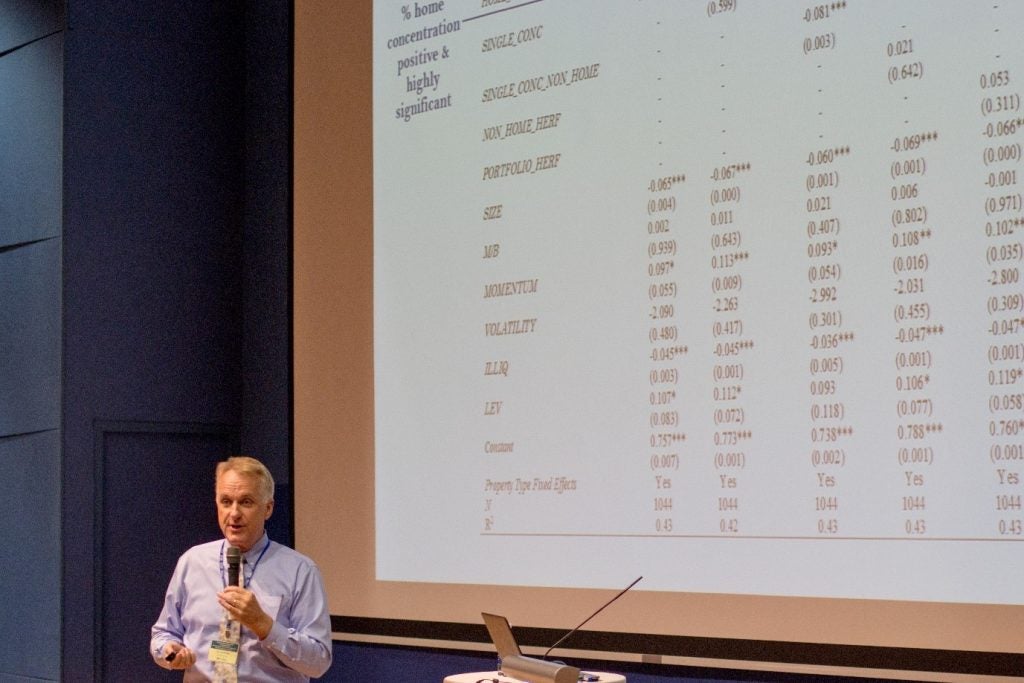

n this Forum, Professor David C. Ling, McGurn Professor of Real Estate, Hough Graduate School of Business, University of Florida, presented his co-authored paper, 'There's no place like home: Local asset concentration, information asymmetries and commercial real estate returns.' The paper sheds light on whether a manager's local information advantage produces higher risk-adjusted returns. The findings, based on Real Estate Investment Trusts (REITs), also offer applicable lessons for managers of private Commercial Real Estate (CRE) portfolios.

Key Findings of the Paper:

1. U.S. REITs with a high concentration of property portfolio in their home market, which is defined based on where the management team resides, generates higher risk-adjusted returns for their investments, outperforming REITs with a low concentration of home market portfolio by a statistically significant percentage of 0.434% in monthly return (or 5.2% annually). The study covers the period from 1996 to 2013.

2. Returns are not the compensation required by investors for concentrated risks undertaken by the manager for putting all their eggs in one basket, but for information advantage of managers in home turf. The superior knowledge of home turf, usually referred to as "home bias" pays off, even after controlling for the exposure to standard macro risk factors.

3. Home bias is most dominant in certain markets, especially those relatively under-researched or with less competitors coming in to compete for the same turf.

Key Lessons from Forum:

1. Concentration Risks and Home Turf Advantages

- The Warren Buffet's approach: 'If you have more than 6-7 assets, you are probably fully diversified', and therefore, REIT managers can meet the diversification objective by just concentrating REITs' investments to a few cities.

- Given information asymmetry, local managers have better information in managing their portfolios vis-à-vis foreign competitors on home turf. Outcome variability is narrowed with decreases in concentration risks and increases in home advantages.

- Global investors should be encouraged to think from both micro and macro perspectives. For the macro, compare absolute performance first (i.e. is your home market a better market than other markets?), instead of focusing on honing a home market advantage even if you may have the 'exact right call on a building'. For the micro, getting the benefit of local knowledge, such as deciding on the "right side of the street", pays off. For instance, "every town has a corner, where there was a small store/deli/cafe, and the tenants that were here have all gone bankrupt. Nobody knows why but for some reason it never works."

2. Overcoming Barriers of Entry when Venturing Abroad

- To reap sufficient scale before venturing abroad, Ascendas REIT, which manages S$8B worth of assets in Singapore, did not start venturing abroad until it had at least S$5B to begin with. The right strategies include not only the ability to attract talent to help run the business better and make it their home market, but also to get assets in one's home turf sufficiently allocated such that the REIT is sufficiently well-priced.

- Ascendas REIT was cognisant that as it invests in long-term investment properties to generate sustainable monthly income for its unit holders, it also constantly taps the capital market in both good times and bad, such that investors could price its stocks fairly. Depending on the REIT stock performance, there is also a conscious and mindful approach in capital allocation. There is due consideration of the following: (1) whether an overseas market provides level-playing field (favourable local regulation/tax), (2) variability of land ownership, and (3) potential to scale up.

- Investors might price one at the "lowest common denominator" if they do not know how to price the REIT's entry into a new territory with divergent risk profiles. There should also be the grooming of talents to bridge the huge divergence in information, to understand nuances of the marketplace, to adopt practices and to bridge networks.

- It is also advisable to focus on locations, where land is a high component of value, as replacement cost matters. This entails buying something at a discount, when it is (a) old, and (b) there is an inherent uplift in rents. It is essential to go back to basics and be reminded that real estate is 'four walls and a roof', hopefully a good roof, driven by supply and demand, because new supply places pressure on rents.

- While the concept of concentration goes against the convention of diversifying across asset classes and geographies, it leads to wealth creation, which should come before wealth preservation.

- It is imperative to select markets and sub-markets with a macro perspective, but transacting and operating from a micro perspective. Whilst physical buildings may be considered local, the tenants and capital flow around the physical buildings are global.

- Outperformance or "alpha" can be achieved through exploiting both information advantages and capability advantages. Having an information advantage will only translate to outperformance if you have the capabilities to act of that information. More importantly, information advantages may come from local (home market) knowledge, but may just as likely come from national or international knowledge that a global investor may possess as opposed to a local investor.

- In each of the 4 stages of the lifecycle of an investment, there are examples where local market knowledge and capabilities provide this advantage. There are also many examples where global knowledge and capabilities provide this opportunity for alpha. Specifically: 1) Originations – an existing US based multinational tenant relationship provided the opportunity for Brookfield to originate a large IT office park opportunity in India. 2) Acquisitions – A national tenant relationship in the US provided Brookfield advantages in underwriting and pricing the debt on a property in which the respective tenant was an anchor tenant. 3) – Operations & Asset Management – having a large scale, national portfolio of self storage properties, provides the opportunities to negotiate more favourable insurance coverage, financing terms and cost efficiencies such as investment in web technology, which owning only a single local property would not provide. 4) Exit – having an understanding of relative global cost of capital and global capital flow dynamincs provides insights to alternative exit options on a property compared to just considering domestic capital options. For example in Australia, domestic capital may consider office cap rates at historic domestic lows, compared to global capital that may consider the relative attractive capital values and yield spreads compared to other global cities.

3. Global trends

- On e-commerce trends, the advantage of operating around the world is that global trends can be spotted via investable portfolios made in one's domicile. Opportunities abound if certain markets are not pricing these trends in yet. As an example, the phenomenon of US' Amazon Prime '2-hours Right Now' changed industrial demand from owning regional distribution centres (2 million sqft) 50km out of town, to owning older warehouses / in-field sheds at in-fill locations to capture the last mile logistical advantage. Hence, having spotted this trend in the US, Blackstone deployed the strategy of capturing the last mile e-commerce advantages in Europe and Australia. It started buying in Australia around 20 months ago and is now the 3rd largest owner of logistics there.

- As a caution, it would be harder to glean local information advantages as more data are now available to all parties. Hence, investors can instead glean advantages from returns that arise from correlation between different markets, especially in countries where MSAs move up or down together as a country, by observing their demographic performances and economic drivers. In the last couple of decades of China's growth, the Chinese market has been driven by massive urbanisation, leading to supply chasing demand for two decades, which means that returns have been good relative to the more established and mature economies.

- Being global also means the opportunity to expose clients' local assets to the global audience, so that a better price may prevail. Two benefits in the marketing and selling of local assets to overseas investors: (1) foreign investors spot something before local ones do as they may be 'trapped in past news', e.g. "$2,000 psf has not been broken before"; and (2) overseas investors can end up overvaluing a property "not on the right side of the street", if incognisant of the locals' preference to work/shop on the asset's potential performance.

- Another global trend apart from e-commerce and big data is the low interest rate environment.

Click Here for Interview video

From left: Professor Joseph Ooi, Mr Chia Nam Toon, Mr Alan Miyasaki, A/Prof Sing Tien Foo, Mr Chris Fossick, Mr Niel Thassim, Professor David C. Ling