Quantifying the value add of an en bloc exercise

Redevelopment potential is highly correlated with hedonic attributes of properties and is difficult to measure ex-post. Using data on en bloc sales in Singapore, Chia and Sing (2020) empirically disentangle and quantify values of redevelopment potentials embedded in old properties.

5 September 2022

Intuitively, the value of a property depends on its intrinsic attributes – for example, floor area, age, number of rooms – as well locational and environmental attributes such as neighbourhood amenities, proximity to transportation nodes, connectivity to other districts, level of pollution, crime rates and other factors.

The hedonic pricing method empirically determines intrinsic values independently for property attributes, and locational and environmental characteristics of real estate. The hedonic pricing model represents a systematic way of assessing property value as a function of its components, which can be represented in a generic form as follows:

Property price = F(hedonic attributes)

Urban rejuvenation triggers teardowns of old housing, especially in mature cities with ageing buildings. Redevelopment that follows adds value which must be factored into valuation as well. For example, when developers intensify land use by building taller structures, the value of the new building is higher than that of the older building on the same site. An additive term (variously known in the literature as "redevelopment option premium," "teardown premium," etc.) can be appended to reflect this value add:

In their paper "Redevelopment Values in Multi-Family Properties: Evidence from En bloc Sales in Singapore", Chia and Sing (2020) disentangle redevelopment option values in hedonic pricing for residential properties using en bloc sales data.

Background

Condominiums and apartments (popularly known as multi-family residential properties in the US and other countries) form the bulk of private homes here, accounting for about 80% of the total private residential stock in 2018.

En bloc sales are collective sales of multi-family properties which, according to the latest regulations, require majority consent of at least 80% by share value and strata area for properties of 10 years and older, and 90% for those under 10 years old.

Demolition of old buildings acquired from en bloc sites is an important source of private land supply in Singapore, in addition to acquiring vacant state lands via the government land sales (GLS) programme.

An en bloc sale process is time intensive and starts with forming a Collective Sale Committee (CSC) at the outset. Among other responsibilities, the CSC will have to collect signatures from property owners and obtain majority consent within one year. Thereafter, the CSC will launch the en bloc sale via a public tender exercise, where the developer with the highest bid will secure the deal after the necessary regulatory approvals.

Experimental Design

For a sample of private non-landed property transaction data from January 1995 to August 2018, Chia and Sing sorted each transaction into either the successful en bloc (treatment) group or the non-en bloc (control) group based on the ex-post en bloc sale status. The non-en bloc group includes developments that attempted for collective sales but were unsuccessful during the sample period.

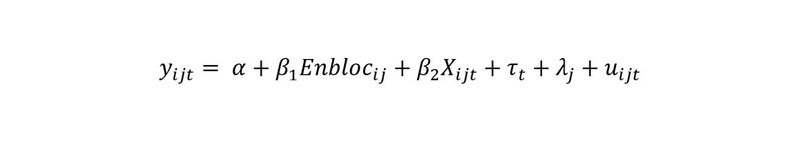

The researchers formulated a quasi-experiment design with the baseline regression model as follows:

yijt is the natural logarithm of resale transacted price of a property unit 𝑖 in a development 𝑗 at time 𝑡. Enblocij is a dummy variable that takes the value of 1 if a property is sold en bloc to developers; and 0 if the property is not sold en bloc at the end of the sample period. Xijt is a vector of property site and locational attributes, and the remaining terms are fixed effect controls and the regression error term.

A positive and significant "Enbloc" coefficient (β1) implies that properties with redevelopment potential sell at higher resale prices than properties without redevelopment potential, ceteris paribus.

Key findings

If endogeneity in the treatment variable is not corrected, the baseline regression results showed that en bloc properties transacted at lower prices – contrary to the expectations – compared to the non-en bloc counterparts.

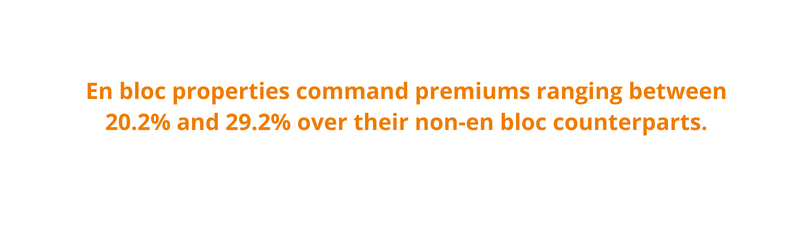

Chia and Sing use the endogenous switching model and propensity score matching (PSM) methodologies to control for potential endogeneity in the models. The outcome is reversed by correcting the endogeneity in the treatment effects, whereby en bloc properties are sold for premiums over non-en bloc properties. Properties in the treatment group command premiums ranging between 21.1% and 26.6%. By further controlling for planning region and postal sector fixed effects, the premiums increased further to range between 20.2% and 29.2%.

As the en bloc process entails the formation of a CSC – which signals the owners' intent to engage in a collective sale – the researchers used this event as a shock to investigate its impact on prices. After the establishment of the CSC, en bloc premiums increased significantly by between 3.6% and 8.1%.

Finally, the researchers found significant anticipative effects in en bloc premiums, which increased when transactions occur closer to the en bloc sale events. With controls for planning region fixed effects and postal sector fixed effects, resale prices of en bloc properties increase at an average rate of 0.05% and 0.03% per month when transactions occur closer to the en bloc sale events.

These results suggest that redevelopment potential (or option) embedded in properties creates additional value on top of a property's hedonic attributes. An en bloc exercise signals redevelopment probability in the near term, increasing property prices. In the inverse scenario, when a property fails in an en bloc attempt, the expected realisation of en bloc gains decreases, which translates into lower prices in the post-failed en bloc period.

Authors:

Tien Foo, Sing is a professor of real estate and Director of the Institute of Real Estate and Urban Studies (IREUS) at the National University of Singapore.

Liu Ee, Chia is a research associate at the Institute of Real Estate and Urban Studies (IREUS) at the National University of Singapore and a Ph.D. candidate at Pennsylvania State University, U.S.